One of the primary reasons banks opt for GPS guard tour systems for ATM patrols is their ability to track locations in real time. Traditional methods often leave gaps in records and fail to verify whether guards have visited remote ATM self-service terminals. In contrast, GPS patrol systems utilize mobile devices or dedicated GPS hardware to record the guards' precise coordinates at each checkpoint automatically. As a result, if a guard deviates from a planned patrol route or fails to arrive at a stipulated time, the bank’s security manager is immediately notified.

In effect, this proactive approach enables supervisors to intervene before minor oversights turn into major security incidents. In addition, transitioning to a digital tracking solution facilitates quick audits: the bank can retrieve time-stamped location logs to verify compliance with service level agreements (SLAs) and regulatory requirements without having to pore over handwritten records.

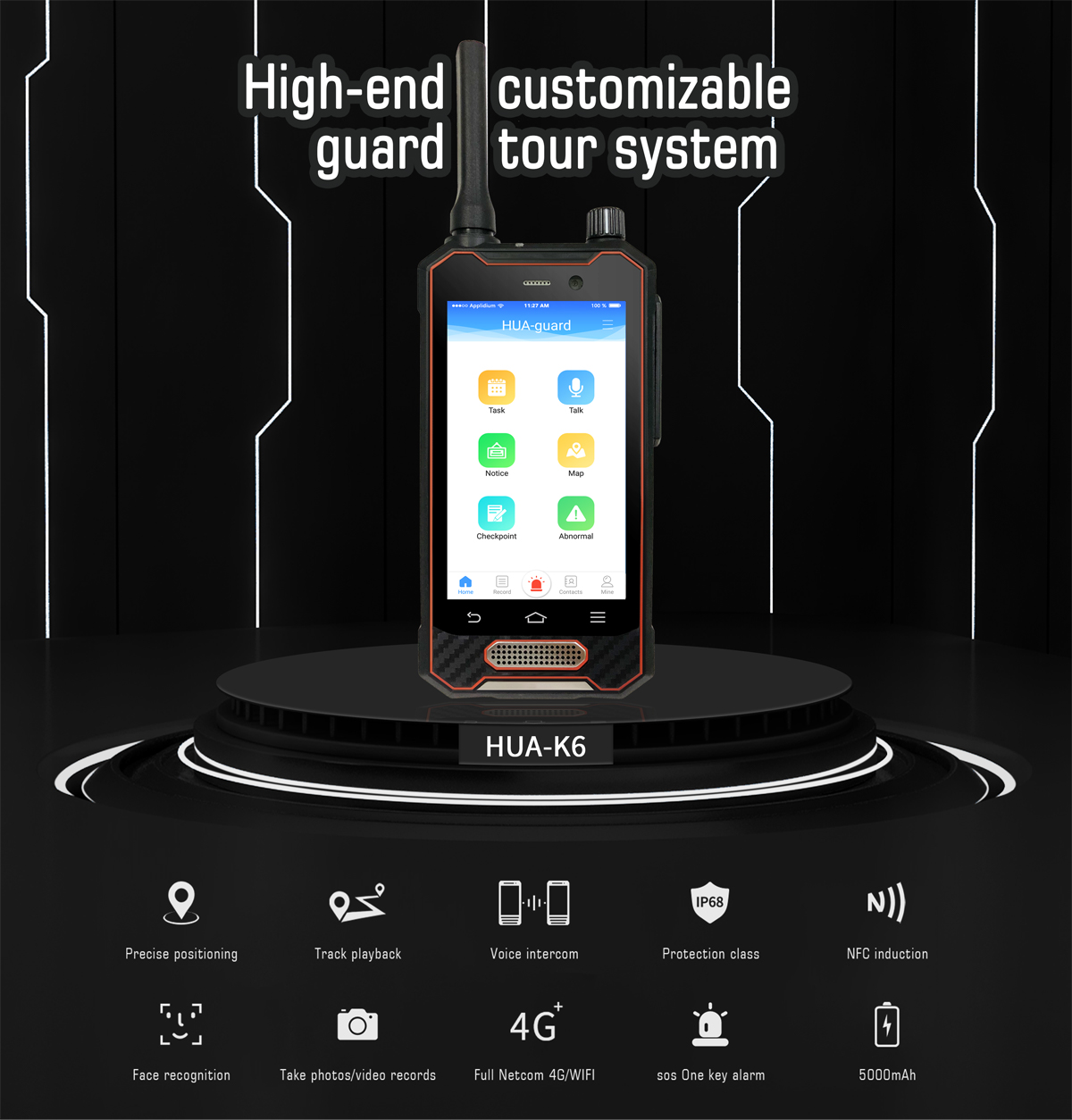

Another key benefit of adopting a GPS guard tour system for ATM patrols is its ability to increase guard accountability and transparency. Discrepancies between expected and actual patrol data were common, with banks previously relying on manual checklists or verbal reports. With the GPS Patrol System, each guard receives unique login credentials for their mobile or handheld device, ensuring that only authorized personnel can initiate or complete patrols. The system then logs each action in a secure cloud database. Managers can view a detailed audit trail, including geotagged photos or status updates for each location.

This digital proof not only holds guards accountable for completing all assigned tasks but also prevents them from taking shortcuts or falsifying reports. Transitioning from opaque paper logs to transparent digital records can enhance trust between security teams and bank leadership, thereby reducing the potential for internal fraud or negligence.

Optimizing inspection routes is crucial for reducing travel time, fuel costs, and overall operational expenses. By using a GPS inspection system, banks can automate and streamline ATM inspection route planning, ensuring that inspectors follow the most efficient checkpoint sequence. The system's software integrates geospatial mapping algorithms to calculate the shortest path between multiple ATMs, taking into account real-time traffic data, road closures, and inspection shifts.

As a result, inspectors no longer need to memorize or manually refer to printed route sheets; instead, they can directly rely on turn-by-turn navigation provided by the GPS inspection system equipment. This level of automation significantly reduces the risk of human error and ensures that every ATM is covered consistently. In addition, if unforeseen circumstances, such as vehicle breakdown or severe weather, disrupt the scheduled route, the system can immediately recalibrate and assign a replacement inspector or adjust subsequent inspection schedules.

Banks must comply with stringent security regulations established by federal agencies, banking associations, and insurance companies to safeguard customer assets and maintain public trust. GPS patrol systems help banks meet and document compliance requirements by automatically generating comprehensive reports that demonstrate compliance with industry standards. For example, regulators may require written evidence that guards check ATMs at least twice a day to detect signs of tampering and verify the keypad's integrity.

In an audit or investigation, these digital records can serve as tamper-proof evidence that the bank is adhering to the required security procedures. Additionally, banks can configure GPS patrol systems to automatically send alerts if guards fail to complete their patrols within a specified time, ensuring that corrective actions are taken promptly.

Effective incident response requires timely information sharing and coordinated actions; GPS guard tour systems significantly enhance banks' ability to manage ATM emergency incidents. When guards patrol, they often face a variety of unpredictable challenges, including equipment failures, power outages, vandalism, and robberies. With GPS guard tour systems, guards can immediately report incidents by triggering alarms or sending geo-tagged messages to the command center. As a result, security teams have real-time situational awareness, including the precise location of guards and the nature of the incident, which enables the immediate dispatch of law enforcement or technical support personnel.

Additionally, the system’s two-way communication capabilities enable command staff to issue immediate instructions, such as reassigning backup personnel or coordinating with local law enforcement. For high-risk scenarios, such as an attempted ATM robbery, every second counts.

Banks rely on GPS patrol systems for ATM patrols to ensure that their cash withdrawal networks are entirely, transparently, and efficiently protected. The system addresses many challenges posed by the geographical dispersion of ATMs by providing real-time location tracking, strengthening patrol accountability, simplifying route optimization, and facilitating compliance with security regulations. Additionally, it enables a rapid response to incidents and meets regulatory requirements, significantly reducing operational risks and enhancing customer trust.